Stripe Payment Gateway Integration - Effortlessly

Receive Money Worldwide

You will get from us:

Stripe Payment Gateway

- We will integrate Stripe gateway, into your existing WordPress website

- This will allow your customers to make online payments directly on your site, using their preferred credit or debit card.

- The integration will be seamless, ensuring a smooth checkout experience

Official Stripe Components

- We use only the official Stripe components for integration

- This means your site will be using the most up-to-date, secure, and efficient code available directly from Stripe

- It reduces potential risks and ensures high levels of security for all transactions

Video Instructions

- If necessary, we can provide you with a step-by-step video tutorial on how to use and manage the Stripe Payment Gateway on your WordPress site

- 7 days of free bug fixing support

- Direct support from our lead developers

From $850 $750 /website

How Do We Work

Our team focuses on creating custom payment integration solutions specifically for WordPress that are designed to meet your unique needs. We carefully analyze your requirements to deliver high-quality solutions.

Consultation & Requirements Gathering

Website

Assessment

Planning & Wireframing

Implementing & Testing

Quality Assurance & Full Payment

Launch &

Support

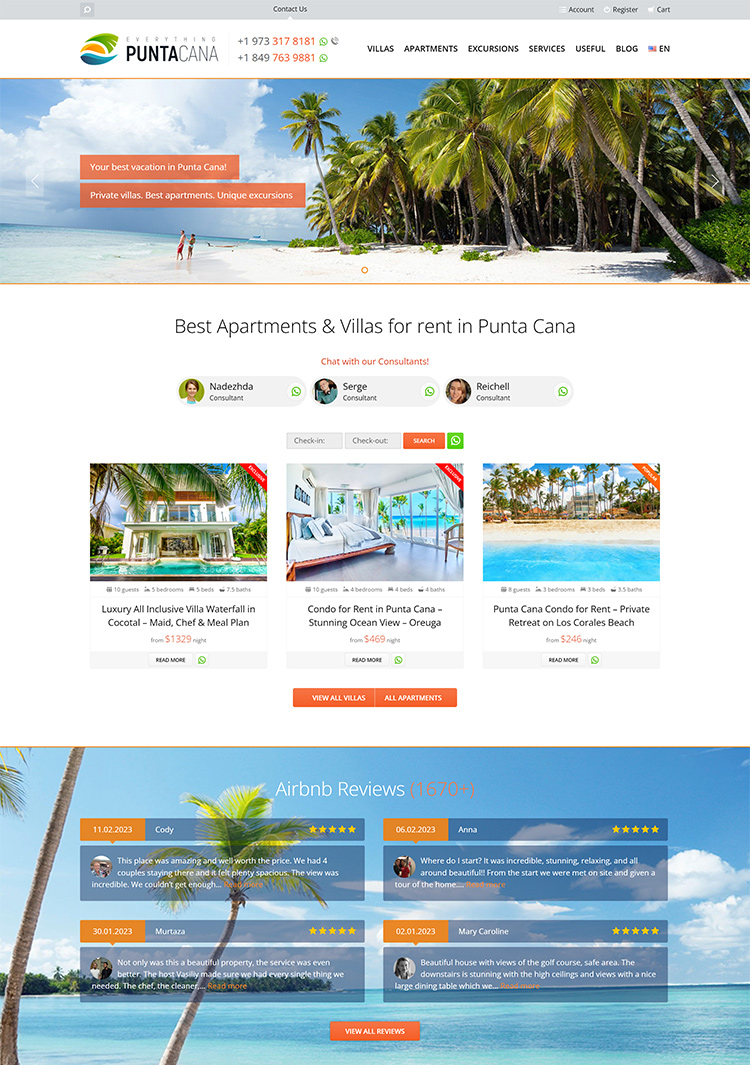

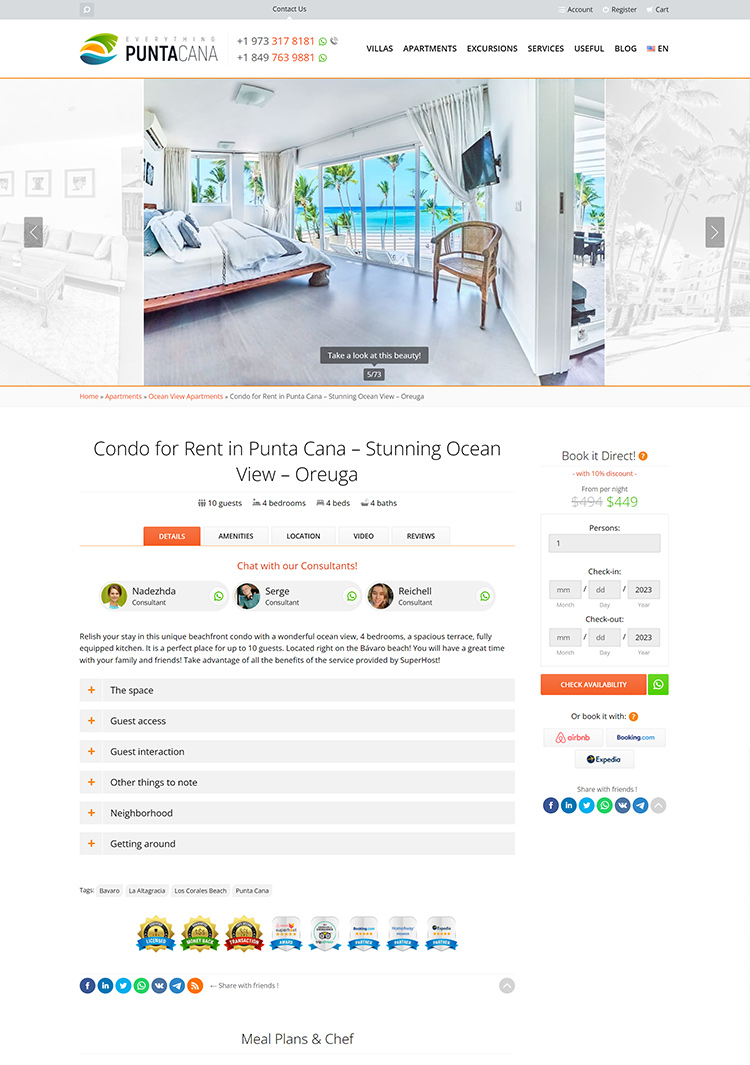

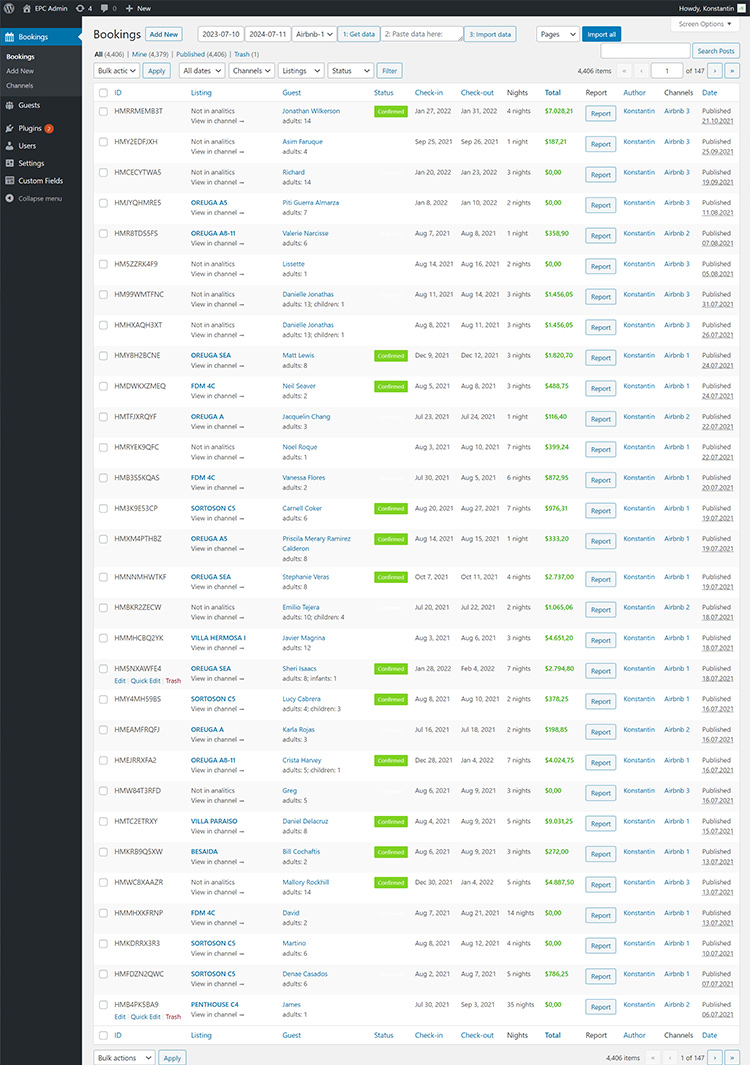

Our eCommerce Works

Frequently Asked Questions

How long does it take to integrate a payment gateway?

The integration process could span anywhere from a few hours to several weeks. Please contact our team of experts for a precise calculation of time and cost specific to your project.

How do you integrate Stripe payment gateway?

To integrate the Stripe payment gateway, we start by setting up a Stripe account for your business and obtaining API keys from the Stripe Dashboard.

We then integrate these keys into your website’s backend code, allowing us to securely send customers’ payment data directly to Stripe, ensuring maximum security.

Stripe Checkout, a pre-built payment form, can simplify the process. After integrating the necessary code, we’ll conduct extensive testing before going live to ensure a smooth, safe payment process for our customers.

What is Stripe payment gateway integration?

Stripe payment gateway integration is a process that connects Stripe’s secure payment system to a website. It’s like adding a virtual credit card machine to your website so that you can accept payments from customers online.

The integration uses specific codes from Stripe that ensure all the payment details of your customer’s input go directly and safely to Stripe’s system. You can even use a ready-made payment form from Stripe to make things simpler.

All of this is thoroughly tested before it goes live to ensure your customers can pay smoothly and safely.

Is Stripe a payment API?

Yes, Stripe is a payment API (Application Programming Interface). This means that it provides a set of rules and protocols for building and interacting with software applications.

In the case of Stripe, it provides developers with the tools they need to create a system for accepting and processing payments on a website or app. This allows businesses to integrate Stripe’s payment processing capabilities directly into their own systems, so they can securely accept payments from customers.

What companies are using Stripe?

Some of the large and well-known companies using Stripe include: Shopify, MindBody, Amazon, DocuSign, Lyft, Under Armour, Blue Apron, Pinterest.

What is payment integration?

Payment integration is adding the ability to accept payments into your website or app. This lets your customers pay for your products or services directly on your website.

We do this by connecting your website to a payment processing system like Stripe, PayPal, or others. These systems handle the secure transfer of money from your customer’s bank account or credit card to your business’s bank account.

In the process, they make sure all sensitive information like credit card numbers are kept safe and secure. They also communicate with the banks to confirm whether the payment can be made.

How does payment integration work?

Payment integration is a system that allows your website or app to accept and process payments from customers. It works by securely sending customer payment information to a payment processor like Stripe or PayPal.

The processor verifies the details and the availability of funds with the customer’s bank. If approved, the transaction proceeds and the funds, minus any processing fees, are transferred to your business’s bank account.

All this happens in a matter of seconds, offering a smooth and efficient shopping experience for the customer.

What is the difference between PayPal and Stripe?

PayPal and Stripe are two renowned payment processors, both easy to use with no contractual obligations. PayPal is ideal for smaller, newer businesses due to its simplicity and no startup fees.

However, if a company wants customization and has technical expertise, Stripe is the better choice.

Stripe charges 2.9% plus 9 cents per transaction, and PayPal’s fee is 2.29% plus 49 cents. For international transactions, PayPal charges an additional 1.50%, whereas Stripe adds an extra 1%, plus another 1% if currency conversion is required.

PayPal is more globally available than Stripe, making it a more recognizable name in e-commerce.

What payment methods does Stripe use?

Stripe’s Invoicing supports a wide range of payment methods, which may be subject to restrictions, such as operating in specific currencies or with payment limitations.

These payment methods can be activated and configured through the Dashboard or API. In cases where an invoice is unpaid past its due date, Stripe can send reminders to the customer by default, but automatic collection can be disabled when an invoice becomes overdue.

The options include:

- ACH Direct Debit: For US-based Stripe users, allowing them to accept payments from customers with a US bank account.

- Alipay: A digital wallet widely used in China.

- Bancontact: The most common online payment method in Belgium.

- Various types of bank transfers: Including Credit transfer (Sources) and Bank transfer (Payment Intents).

- BECS Direct Debit in Australia: For Australian Stripe users to accept payments from customers with an Australian bank account.

- Boleto: A single-use payment method primarily used in Brazil.

- Cash App Pay: A reusable payment method in the US.

- Cards: Globally recognized and widely used method of online payment.

- EPS: An Austria-based payment method allowing customers to complete transactions online using their bank credentials.

- FPX (Financial Process Exchange): A Malaysia-based online payment method.

- Giropay: A Germany-based online payment method that allows customers to complete transactions using their online banking details.

- iDEAL: A Netherlands-based online payment method.

- PADs (Pre-authorized payment method): For Canadian and US-based Stripe users to accept payments from customers with a Canadian bank account.

- Konbini: A Japanese payment method enabling customers to pay for bills and online purchases at convenience stores with cash.

- PayNow: A real-time bank transfer service available to customers in Singapore.

- PromptPay: A payment method for customers in Thailand to use their preferred app from participating banks.

- Przelewy24: A Poland-based payment method allowing customers to complete transactions online using bank transfers and other methods.

- SEPA direct debit: A payment initiative of the European Union to simplify payments within and across member countries.

- Sofort: Allows Stripe users in Europe and the US to accept Sofort payments from customers in select countries.

- WeChat Pay: Payment solution from China’s largest internet company, Tencent.

What is an example of an integrated payment?

A typical example is the shopping cart feature on an e-commerce website. In this scenario, a customer can choose a product, add it to their cart, and complete the purchase within the website.

The website might use a payment gateway like Stripe or PayPal to process the transaction securely. Still, from the customer’s point of view, the entire process happens seamlessly within the same digital environment.

Is Stripe better than PayPal?

The choice depends on the specific needs of your business, the types of transactions you handle, the products you sell, and the profiles of your customers.

Stripe might be a better option for businesses with many international sales due to its easy use with credit card payments.

At the same time, PayPal could be a more suitable choice for those who prioritize safety and have a customer base that widely uses PayPal.

What are the limitations of Stripe?

Stripe API has certain limitations to ensure stability and prevent abuse. Here are the key ones:

Rate Limits: Stripe allows up to 100 read and 100 write operations per second in live mode for most APIs, and 25 operations per second for each in test mode. For the Files API and the Search API, the limit is 20 operations per second in both live and test modes.

Concurrency Limits: This limitation restricts the number of requests that can be active at the same time. This limit is less commonly encountered than the rate limit but could come into play for particularly resource-intensive, long-lasting requests.

These limits are adjustable. Suppose these restrictions impact your business operations or anticipate higher limits. In that case, you can contact Stripe’s support for assistance or request an increased limit, preferably six weeks before significant increases.

What countries cannot use Stripe?

It’s simpler to enumerate the countries where Stripe is supported. If your country isn’t included in this list, then it doesn’t support this payment gateway. So, here is the list of countries where Stripe is available:

- Australia

- Austria

- Belgium

- Brazil

- Bulgaria

- Canada

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Gibraltar

- Greece

- Hong Kong

- Hungary

- India

- Indonesia (Invite only)

- Ireland

- Italy

- Japan

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malaysia

- Malta

- Mexico

- Netherlands

- New Zealand

- Norway

- Poland

- Portugal

- Romania

- Singapore

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- Thailand

- United Arab Emirates

- United Kingdom

- United States

How many countries accept Stripe?

Stripe is currently operational in 46 countries and plans to extend its services to even more.

- Australia

- Austria

- Belgium

- Brazil

- Bulgaria

- Canada

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Gibraltar

- Greece

- Hong Kong

- Hungary

- India

- Indonesia (Invite only)

- Ireland

- Italy

- Japan

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malaysia

- Malta

- Mexico

- Netherlands

- New Zealand

- Norway

- Poland

- Portugal

- Romania

- Singapore

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- Thailand

- United Arab Emirates

- United Kingdom

- United States

Advantages of Stripe Payments

Start Receiving Payments Worldwide

Don’t hesitate to reach out if you need more information about our services, pricing, or anything else. We’re always here and ready to help you!