Vacation Rental Payment Processing - Expand the

Reach of Your Payment Acceptance

You will get from us:

Stripe & PayPal Integration

- Stripe and PayPal payment gateways integration with your existing WordPress website using the powerful WooCommerce plugin

- The integration will be seamless, guaranteeing your customers a smooth and efficient checkout experience.

Only Official Components

- Our web development services exclusively rely on official Stripe and PayPal components.

- You can rest assured that your payment gateway will be secure, reliable, and optimized for an exceptional customer experience.

Video Instructions

- We can provide video instructions if needed to assist you throughout the process.

- You will have a clear and visual demonstration of the steps involved, so that you can follow along effortlessly

From $1450 $1300 /website

How Do We Work

Thanks to our ten years of experience working with leading OTA channels, we confidently assure you of the high quality of our services.

Consultation & Requirements Gathering

Website

Assessment

Planning & Wireframing

Implementing & Testing

Quality Assurance & Full Payment

Launch &

Support

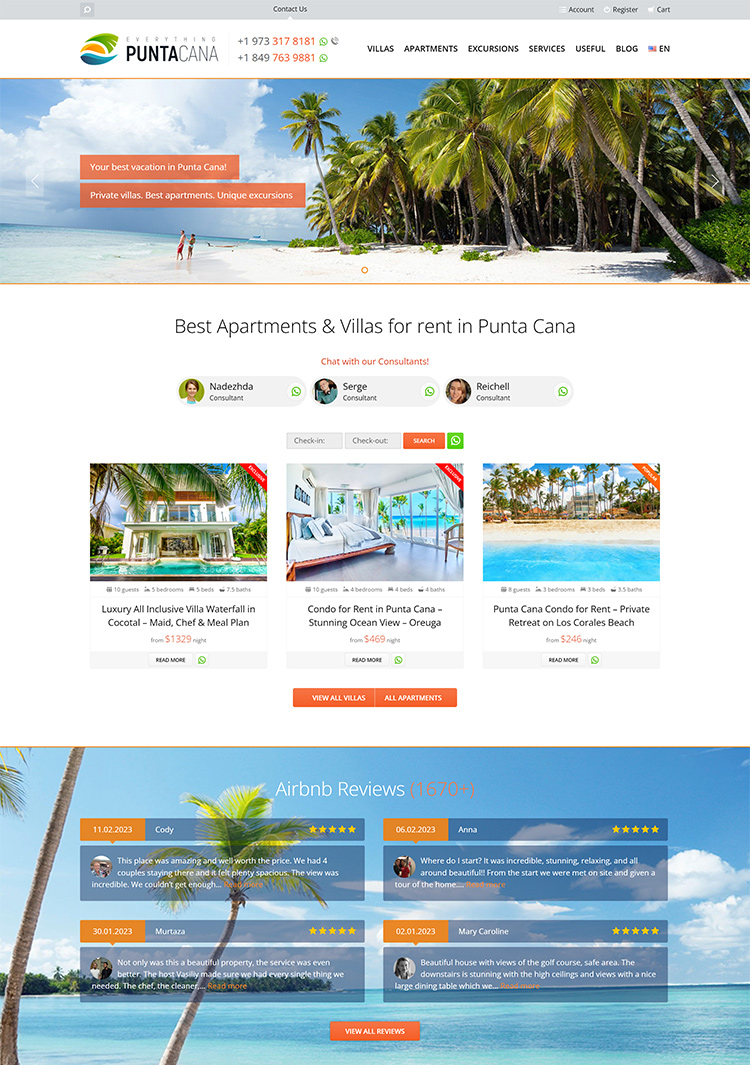

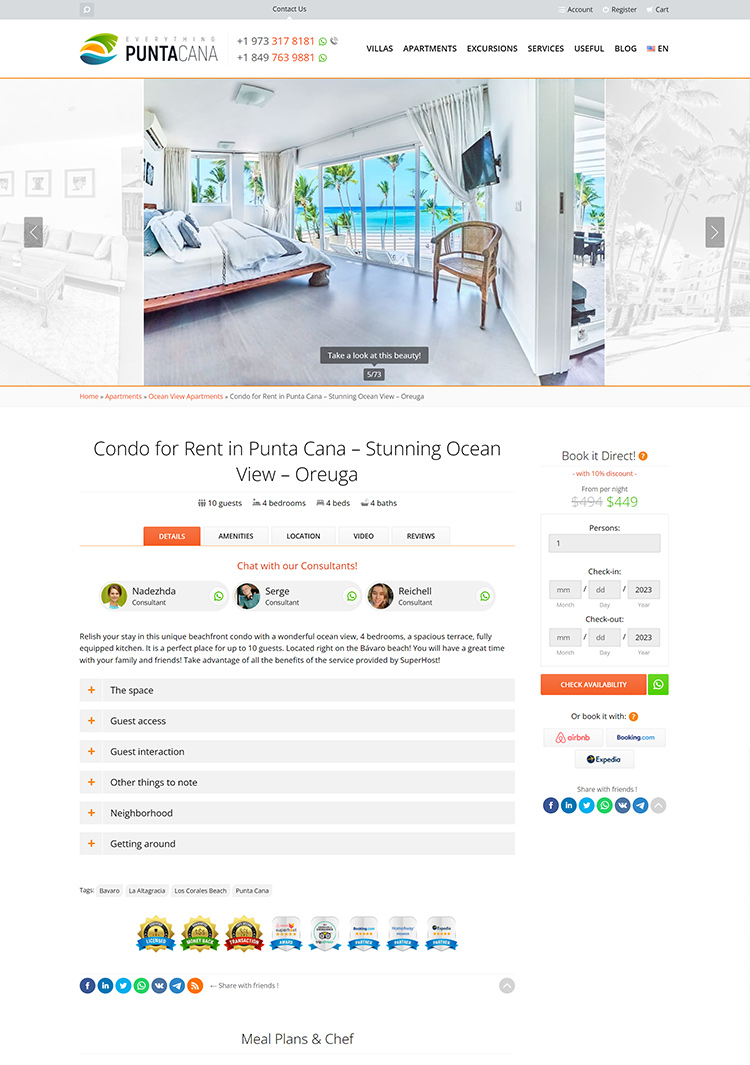

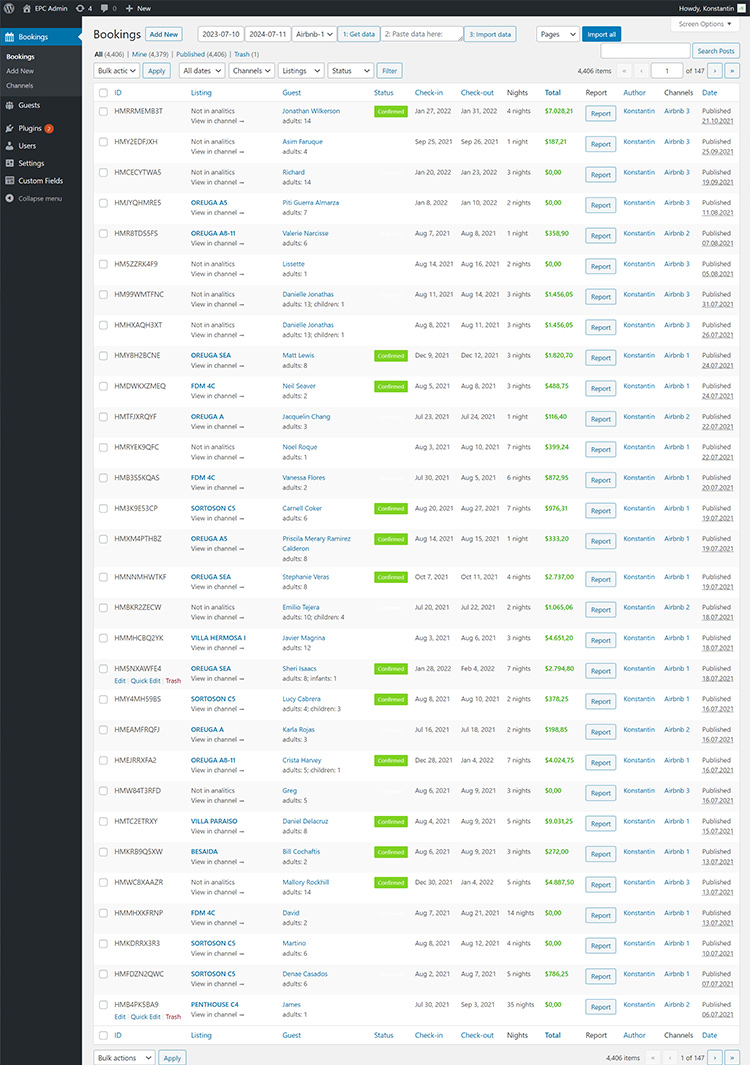

Our Successful eCommerce Works

Frequently Asked Questions

How does vacation rental payment processing work?

Guests input their payment details, and the system processes the specified amount, including the rental fee and any additional charges. Once the payment is successful, it’s transferred to the property manager’s account, ensuring a smooth and secure transaction process.

How long does it take to integrate a payment gateway?

The integration process could span anywhere from a few hours to several weeks. Please contact our team of experts for a precise calculation of time and cost specific to your project.

What is Stripe payment gateway integration?

Stripe payment gateway integration is the process of linking Stripe’s secure payment system to a website, enabling it to function like a virtual credit card machine.

By using specific codes from Stripe, the integration ensures that customers’ payment details are securely transmitted to Stripe’s system. Additionally, the option to use a ready-made payment form from Stripe simplifies the process.

Rigorous testing is conducted before going live to guarantee a smooth and secure payment experience for customers.

What is payment integration in WordPress?

Integrating Payments in WordPress involves connecting payment gateways to your website, enabling secure and convenient online payments for customers purchasing products or services.

How does PayPal work as a payment gateway?

When customers decide to make a purchase on your website and proceed to the checkout page, they have the option to select PayPal as their preferred payment method.

If they already have a PayPal account, they can simply sign in to complete the payment.

Alternatively, for customers who don’t have a PayPal account, they can choose the guest checkout option. This allows them to enter their credit/debit card details directly on PayPal’s platform.

What is payment integration?

Payment integration is a process of enabling your website or app to accept payments directly from your customers. By connecting your platform to a reliable payment processing system like Stripe, PayPal, or others, we facilitate secure money transfers from your customers’ accounts to your business’s bank account.

During this process, the payment system ensures the utmost security of sensitive information, such as credit card details, keeping them safe from any potential threats. Additionally, the system communicates with the respective banks to confirm the feasibility of each payment. This way, you can offer a seamless and secure payment experience to your customers, allowing them to pay for your products or services directly on your website.

How does payment integration work?

Payment integration enables your website or app to accept and process payments securely from customers. It involves sending customer payment information to a trusted processor like Stripe or PayPal, which verifies the details and funds with the customer’s bank. Once approved, the transaction proceeds, and the funds (minus processing fees) are swiftly transferred to your business’s bank account, ensuring a smooth and efficient shopping experience for the customer.

What is the difference between PayPal and Stripe?

PayPal and Stripe are well-known payment processors, both user-friendly and without contractual obligations. PayPal is particularly suited for smaller or newer businesses because of its simplicity and lack of startup fees.

On the other hand, if a company seeks customization and possesses technical expertise, Stripe is the preferred choice.

Regarding transaction fees, Stripe charges 2.9% plus 9 cents per transaction, while PayPal’s fee is 2.29% plus 49 cents. For international transactions, PayPal adds an extra 1.50%, whereas Stripe includes an additional 1%, with an extra 1% for currency conversion.

Notably, PayPal enjoys wider global availability compared to Stripe, making it a more recognizable name in the e-commerce industry.

What are the benefits of payment gateway?

Payment gateways provide a secure and convenient solution for online payment processing, mitigating fraud risks, expanding global reach, and enhancing customer satisfaction. Through automated transactions, diverse payment options, and real-time reporting, both businesses and customers reap significant benefits.

Can I use multiple payment gateways?

Certainly! Your website can offer a variety of payment options, including PayPal and Stripe.

Is Stripe better than PayPal?

The best payment option depends on your business’s specific needs, the types of transactions you handle, the products you sell, and your customers’ profiles.

If your business involves many international sales and credit card payments, Stripe could be a better fit due to its user-friendly interface.

On the other hand, if safety is a top priority and your customer base frequently uses PayPal, then PayPal might be the more suitable choice.

How do I secure my payment gateway on my website?

We prioritize security by following industry-leading standards, ensuring a safe and seamless connection.

We safeguard all transaction data through strong encryption protocols and secure communication channels, providing you and your customers with peace of mind during payment processing.

Why is PayPal recommended for e-commerce?

PayPal enables you to accept payments from customers worldwide, regardless of their location – be it the US, Europe, Asia, or anywhere else. They can pay you in their local currency, eliminating the need for currency conversions, making it a hassle-free way to conduct global business.

How many countries accept Stripe?

Stripe is currently operational in 46 countries and plans to extend its services to even more.

- Australia

- Austria

- Belgium

- Brazil

- Bulgaria

- Canada

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Gibraltar

- Greece

- Hong Kong

- Hungary

- India

- Indonesia (Invite only)

- Ireland

- Italy

- Japan

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malaysia

- Malta

- Mexico

- Netherlands

- New Zealand

- Norway

- Poland

- Portugal

- Romania

- Singapore

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- Thailand

- United Arab Emirates

- United Kingdom

- United States

Key Benefits of Implementing Stripe

& PayPal For Your Website

Order Stripe & PayPal Integration

Feel free to reach out to us for more information or to get started with our integration services. We look forward to working with you!